Is Investing in Real Estate in Bangladesh a Good Option for Long-Term Wealth Creation?

- Jun 27, 2024

- Posted by: Tropical Homes

- Category: blog

People often want to invest their lifetime wealth but get confused due to the range of investment opportunities available. However, there’s a key difference between ‘investment opportunities’ & ‘safe investment opportunities’. Investing in real estate has long been considered a reliable avenue for wealth creation. For years, even before the inception of the modern real estate business, people have invested in real estate to ensure their long-term benefit.

However, the general mass in Bangladesh is still confused about their investment decisions. After all, making an investment decision can be quite complex. It can involve an analysis of market trends, economic conditions, legal frameworks, and specific regional opportunities. That’s why we are going to provide you with a brief yet comprehensive guide on why real estate should be your best investment opportunity.

How Investing in Real Estate Can Benefit You?

If you are still wondering how investing in real estate can benefit you, just wait till you read this section. There are several benefits of real estate investments. We have only jotted down the most lucrative points, just like the tip of an iceberg.

High Return on Investment (ROI)

As Bangladeshis are increasingly converging into cities, real estate prices in those areas offer the potential for substantial returns. Property values in prime urban locations have been appreciating steadily. It is mainly driven by the increasing need for housing & commercial spaces.

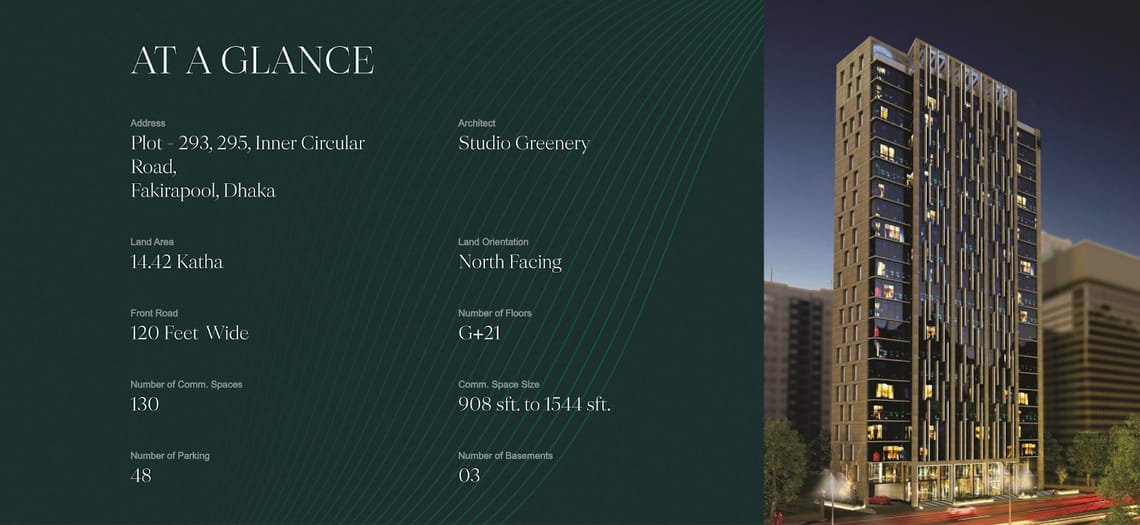

So any investors can benefit from capital gains when property values increase over time. You can wait 5 to 10 years and see the real estate price doubling. It gives you one of the highest ROI in the country. However, if you are business-minded, you should consider investing in commercial projects such as Metro Center in Fakirapool, Dhaka. Commercial projects can ensure a higher ROI than normal residential projects.

Hedge Against Inflation

In the current inflation scenario in Bangladesh, leaving money in a bank is hardly a smart choice. Bank interest rates have started to fall lower than the inflation index. Therefore, it’s high time you consider some investment opportunities to keep your money from being deflated. As we just talked about high ROI in real estate investments, it’s only fair to say that real estate investments are one of the best options against inflation.

Real estate is a tangible asset that typically appreciates over time, making it an effective hedge against inflation. As the cost of living increases, so do property values and rental incomes. This characteristic helps investors preserve their purchasing power and maintain the real value of their wealth. You can also invest in commercial spaces in Karwan Bazar, such as Tropical Noor Tower.

Steady Income Stream

Real estate investments can generate a steady and reliable income through rent yields. Residential properties, commercial spaces, and industrial units can all provide regular rental income, contributing to cash flow and financial stability. This consistent income can be particularly beneficial for retirees or those seeking passive income sources.

According to most of the national dailies, flat rentals are on the rise. Every year rentals are increased all over Dhaka. And as it’s a long-term asset, you can rely on this income stream for a long time.

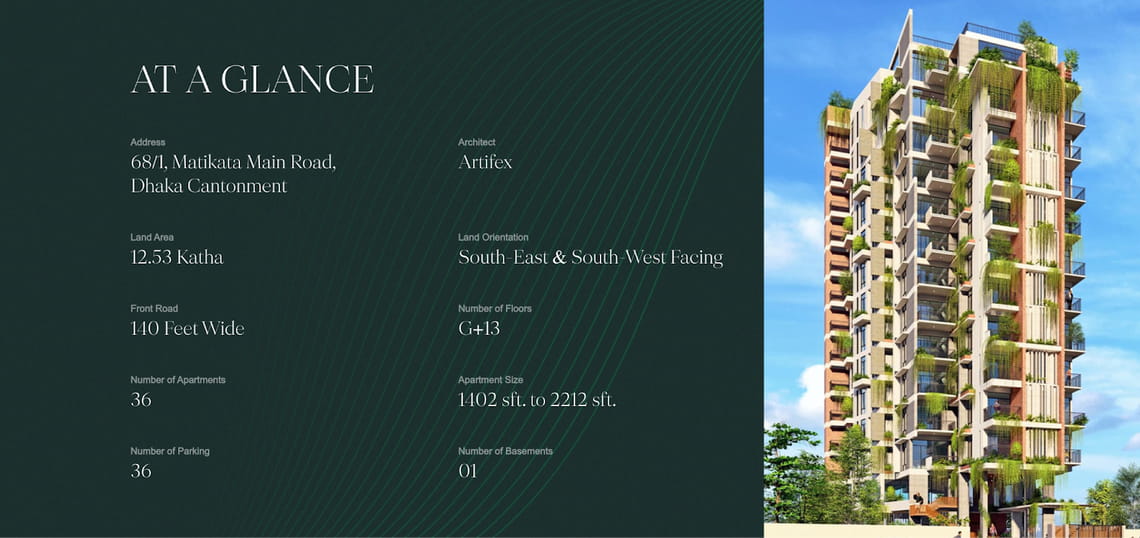

You can opt to buy a residential space like Tropical Hijoltola in Dhaka Cantonment, or even a commercial space in Dhaka.

Tax Benefits & Incentives

Investing in real estate in Bangladesh comes with various tax advantages. According to the National Board of Revenue, the tax rate for land is 5% for Dhaka, Gazipur, Narayanganj, Munshiganj, Narsingdi, and Chittagong districts and 3% for other districts.

However, property owners can claim deductions on mortgage interest, property taxes, and other expenses related to property maintenance and management. These tax benefits can enhance the overall profitability of real estate investments and reduce the tax burden on investors.

Portfolio Diversification

Including real estate in an investment portfolio can provide diversification, reducing overall risk. The investment portfolio is the set of your investment. The rule of thumb for making a good portfolio is investing in opposite or complementary industries. Because whenever stock prices decrease for a particular industry, they automatically increase for the opposite industry.

However, real estate typically has a low correlation with other asset classes, such as stocks and bonds. This means, real estate is more stable and makes your investment portfolio more solid. So adding real estate to your investment portfolio can protect the portfolio from market volatility and economic downturns, offering stability and balance.

Development and Urbanization Opportunities

Bangladesh’s rapid urbanization and economic development create numerous opportunities for real estate investment. Cities like Dhaka, Chittagong, and Sylhet are experiencing growth in both residential and commercial real estate sectors. This urban expansion presents chances for investors to capitalize on new developments and emerging neighborhoods.

This is also an opportunity for the masses. Many people can’t afford to invest in real estate in the heart of Dhaka city. However, as the suburbs are being increasingly developed, it’s a good investment opportunity for the masses. Areas like Gazipur, Tongi, and Savar are now good investment destinations.

Better Living Condition & Lifestyle

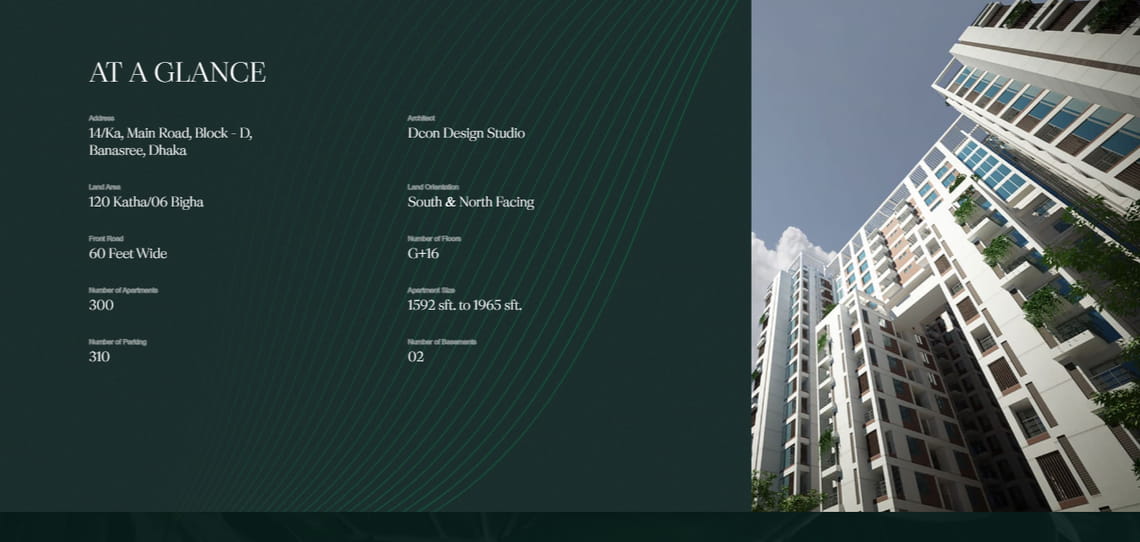

Investing in real estate can also provide lifestyle benefits, such as access to high-quality living environments and vibrant communities. Modern housing complexes often come with amenities like parks, gyms, and recreational facilities, enhancing the quality of life for residents, just like Tropical Homes’ condominium, Tropical Haider Amorapuri in Banasree.

Besides, a lot of homeowners in Dhaka won’t allow any major modifications to their houses. But when you buy your flat, you have the independence to decorate your home to your heart’s content.

Social Status

Until now, we have talked only about the financial benefits. But owning real estate, especially flats, can also please you psychologically. It gives a sense of social status. A lot of people in Bangladeshi society think that it’s a matter of prestige to buy a flat or land.

If you want to taste this satisfaction, It’s high time you invest in real estate. There are very few things that will boost your social status as much as owning a flat in Gulshan. It’s the perfect combination of wealth and satisfaction. After all, you live once, so make your dreams come true & live to the fullest.

Summing Things Up

Investing in real estate in Bangladesh presents a compelling opportunity for long-term wealth creation. The country’s economic growth, urbanization, rising middle class, and supportive government policies create a favorable environment for real estate investments.

By carefully selecting properties, conducting thorough research, and leveraging the expertise of reputable real estate companies like Tropical Homes, investors can capitalize on the numerous benefits and build a diversified, profitable investment portfolio.

Frequently Asked Questions (FAQs)

1. Which cities in Bangladesh offer the best opportunities for real estate investment

Dhaka, Chittagong, and Sylhet are among the top cities for real estate investment in Bangladesh.

2. How can I finance a real estate investment in Bangladesh?

Financing options include personal savings, bank loans, and mortgages. Leveraging financing can allow you to control more significant assets with less capital.

3. How can I ensure compliance with Bangladeshi real estate regulations?

Working with a reputable real estate company like Tropical Homes can help ensure compliance with zoning laws, property registration processes, and other legal requirements.

4. What are the potential risks of investing in real estate in Bangladesh?

Potential risks include market fluctuations, regulatory changes, infrastructure development delays, and economic or political instability. Especially, regulatory and political unrest is one of the key factors for Bangladesh.